ChildHope is making a beautiful difference in the lives of vulnerable children across Latin America and the Caribbean through the faithful and generous gifts of people like you. And we are grateful!

Together, we are providing an excellent education, discipleship in the faith, and hope for the future … and you can do even more for children in need through planned giving by year’s end.

You may even discover great tax advantages when you choose to give a rollover gift from your IRA (if you’re 70-1/2 years or older, you can give up to $100,000 from your IRA, and you will avoid paying tax) — or when you give a gift of appreciated assets.

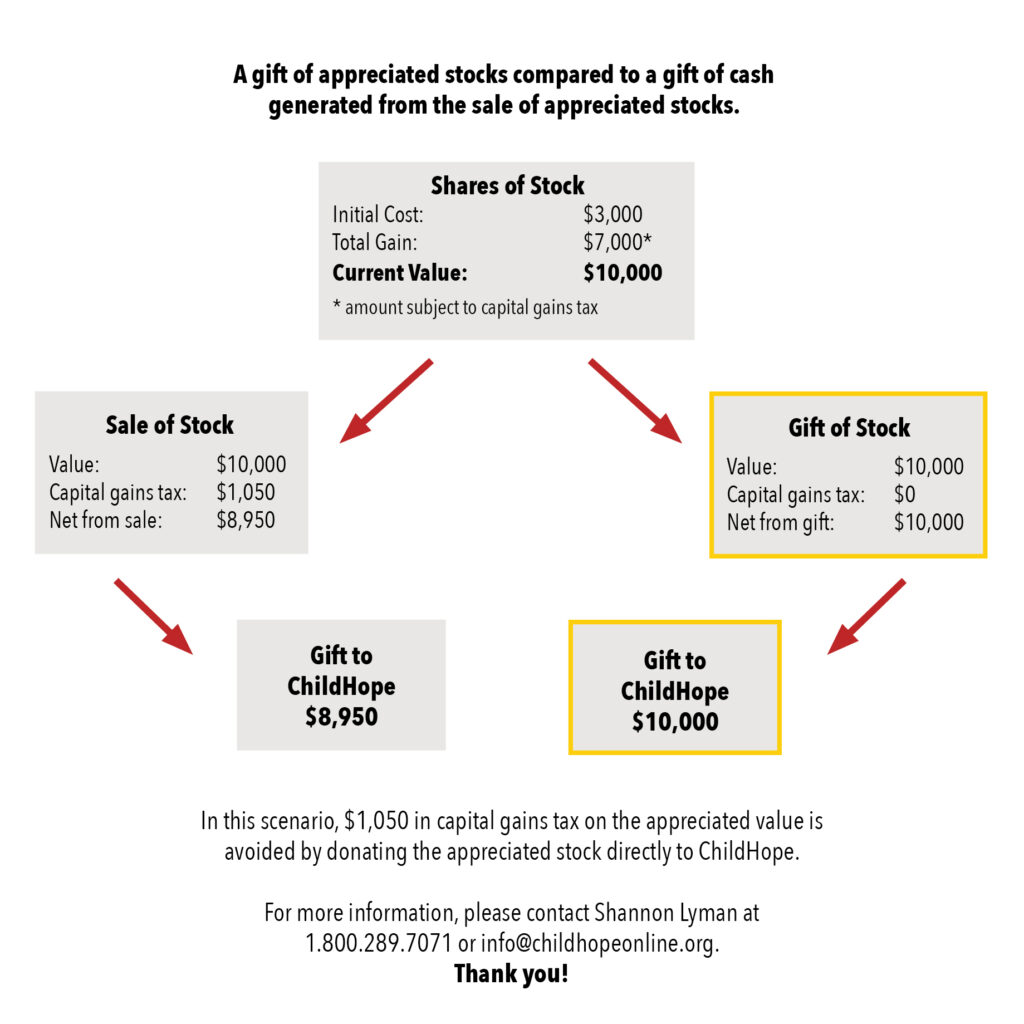

If you’ve held a stock or other asset for more than a year, and it has appreciated in value, you can donate it, receive a tax deduction for the fair market value of the asset, and usually avoid capital gains tax, too. The chart shows how donating an appreciated asset actually allows you to give an even greater gift.

Thanks for all you do to bring hope to children in need! Please consider your year-end giving now, and if we can help with your plan, please contact Shannon Lyman at 1.800.289.7071 or [email protected] for more information.